Cao News Hub

Your daily source for trending news and informative articles.

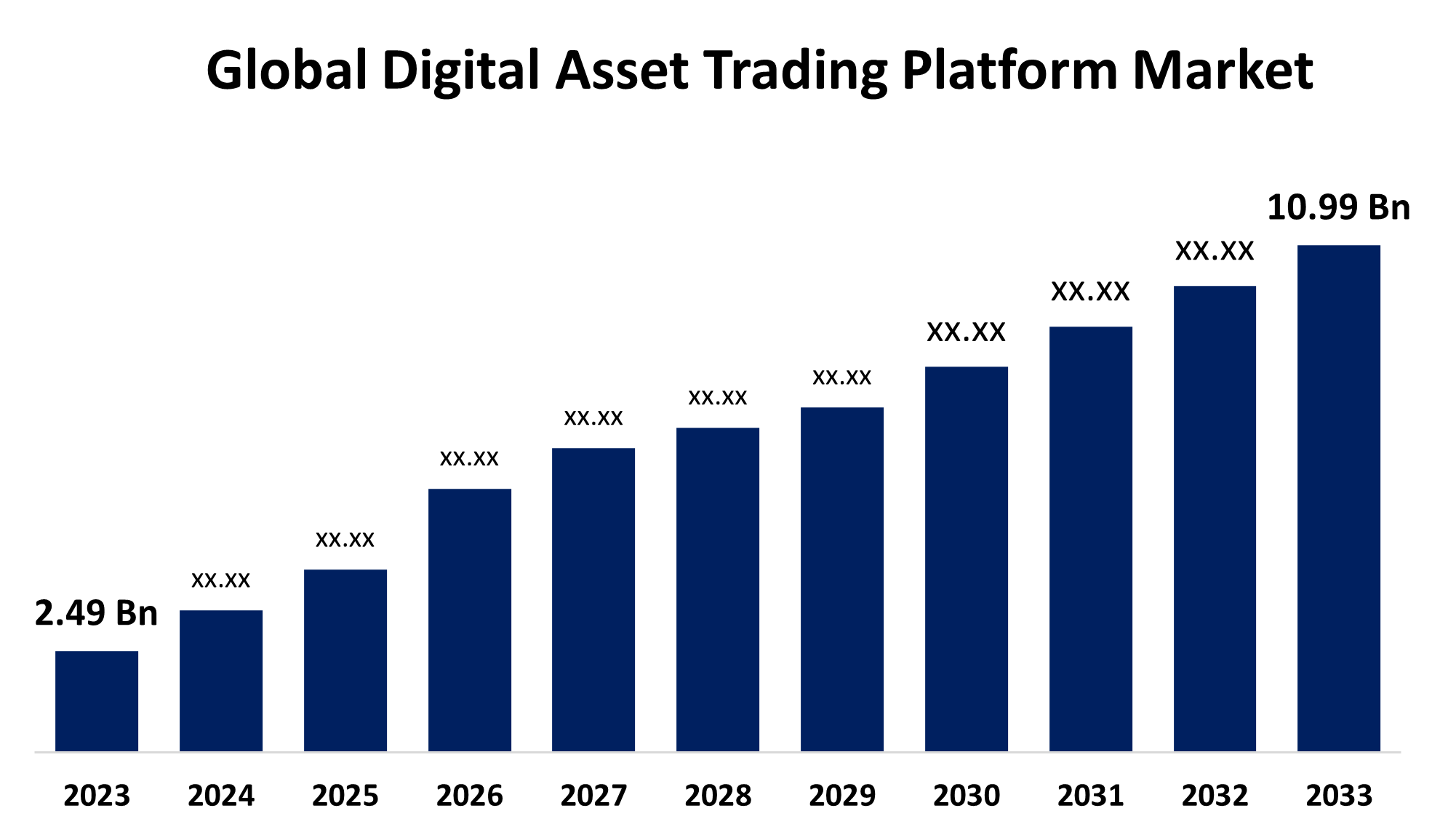

Digital Asset Trading: Cashing in on the Virtual Gold Rush

Unlock the secrets to digital asset trading and ride the wave of the virtual gold rush. Discover how to cash in on this booming market today!

Understanding Digital Assets: Your Guide to the New Frontier of Trading

Understanding digital assets is essential in today's rapidly evolving financial landscape. Digital assets encompass a wide range of online valuables, including cryptocurrencies, non-fungible tokens (NFTs), digital art, and even online gaming items. As the market for these assets continues to grow, many are looking to explore the new frontier of trading that digital assets offer. However, navigating this space can be complex, requiring not only a basic understanding of blockchain technology but also the risks associated with volatility and regulatory issues.

To begin your journey into the world of digital assets, it is important to familiarize yourself with the key terms and concepts. Here are some essential elements to consider:

- Blockchain Technology: The underlying technology ensuring the security and transparency of digital assets.

- Cryptocurrency: Digital or virtual currencies that use cryptography for security, allowing for peer-to-peer transactions.

- Non-Fungible Tokens (NFTs): Unique digital items verified using blockchain, gaining popularity in the art and entertainment sectors.

Counter-Strike is a highly competitive first-person shooter game that has gained immense popularity since its release. Players engage in team-based combat, where they can choose to play as terrorists or counter-terrorists. The game offers numerous skins and weapons, and players often look for ways to enhance their experience. If you're interested in customizing your gear, check out the daddyskins promo code to get some great deals!

Top 5 Strategies for Successful Digital Asset Investment

Investing in digital assets has become a viable alternative for many individuals seeking to diversify their portfolios. The first strategy that can significantly boost your chances of success is researching the market trends. Understanding the nuances of crypto markets or the NFT space can help you identify potential opportunities before they become mainstream. Keep an eye on news, social media discussions, and industry reports to gauge emerging trends.

Another essential strategy is to diversify your investments. Instead of putting all your funds into a single digital asset, consider spreading your investments across various categories such as cryptocurrencies, NFTs, and digital real estate. This approach not only mitigates risk but also allows you to benefit from multiple growth avenues. Utilize asset allocation techniques, and regularly review your portfolio to rebalance it as necessary, ensuring that you remain aligned with your financial goals.

Is Digital Asset Trading Right for You? Key Considerations and FAQs

When contemplating digital asset trading, it's essential to assess your goals, risk tolerance, and market knowledge. Are you seeking short-term gains, or are you more interested in long-term investments? Understanding the volatility of digital assets like cryptocurrencies can help you determine your approach. A diversified portfolio can mitigate risks, so consider experimenting with various asset types. For beginners, it may be wise to start with smaller trades while you learn the ins and outs of the market.

In addition to your investment strategy, consider the tools and platforms you'll use for trading. Ensure you choose a reputable exchange that aligns with your trading preferences, whether that means high liquidity, user-friendly interfaces, or low fees. Finally, it’s crucial to stay informed about the regulatory landscape and potential tax implications surrounding digital asset trading. For more specific inquiries, refer to our FAQs section to address common concerns and enhance your understanding of this complex market.